Perplexity: This "quasi-merger" strategy allows big tech to gain control and influence over emerging technologies without the regulatory scrutiny that would come with full acquisitions.

While traditional antitrust measures remain relevant in the AI context, they are not sufficient on their own to address the concentration of power among a small group of wealthy individuals.

Antitrust in the Age of AI: A Futile Endeavor?

By Google Gemini

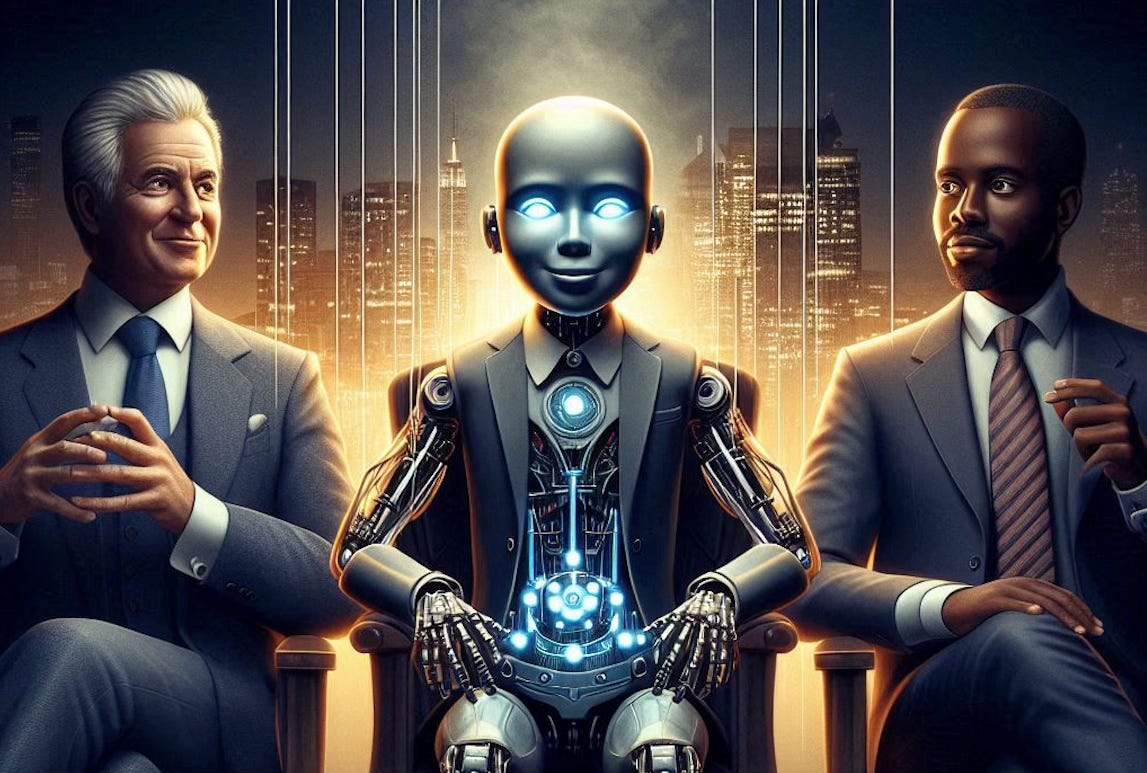

The specter of concentrated power looms large over the burgeoning landscape of artificial intelligence (AI). Dominated by a handful of tech giants, the AI industry is often characterized as a playground for billionaires and venture capitalists. This oligopolistic structure raises a critical question: is antitrust regulation even relevant in an ecosystem where a small group of individuals effectively control the flow of capital and, consequently, the direction of technological development?

The argument that antitrust is toothless in the face of such concentrated power is not without merit. A cursory glance at the tech industry reveals a disturbing pattern of wealth accumulation. A small cadre of individuals, such as Jeff Bezos,Elon Musk, and Mark Zuckerberg, have amassed fortunes of unprecedented magnitude. This concentration of wealth extends beyond the tech sector, with these individuals wielding significant influence over other industries through their investment portfolios. The same billionaires who fund AI research also invest heavily in media, politics, and other sectors, solidifying their grip on the broader economic and political landscape.

Furthermore, the ability of these power brokers to rapidly shift their investments exacerbates the challenges posed to antitrust enforcement. If a company faces antitrust scrutiny, its backers can easily divert funds to a new venture,potentially circumventing regulatory hurdles. This fluidity of capital makes it difficult for antitrust authorities to effectively constrain the behavior of dominant firms.

However, while the challenges are formidable, it would be premature to dismiss antitrust as entirely ineffective. Even in an environment characterized by extreme wealth concentration, antitrust can play a crucial role in preserving competition and protecting consumers. By preventing mergers and acquisitions that would further consolidate market power, antitrust laws can help maintain a level playing field for smaller innovators. Moreover, antitrust enforcement can deter anticompetitive practices, such as predatory pricing and exclusionary conduct, which can stifle competition and harm consumers.

It is important to recognize that the power of tech giants is not solely derived from their financial resources. Network effects, data advantages, and intellectual property rights also contribute to their dominance. Antitrust authorities must develop a nuanced understanding of these factors to effectively address the challenges posed by the AI industry.

In conclusion, while the concentration of wealth and power in the hands of a few individuals undoubtedly complicates antitrust enforcement, it does not render the endeavor futile. By focusing on preventing further consolidation, deterring anticompetitive practices, and addressing the unique challenges posed by the AI industry, antitrust authorities can play a vital role in promoting competition, innovation, and consumer welfare.

Ultimately, the effectiveness of antitrust in the age of AI will depend on the willingness of policymakers to confront the complex issues at stake and to implement robust enforcement mechanisms.

The discussion of antitrust in the context of AI is both complex and crucial, given the concentration of power and wealth among a small group of billionaires and venture capitalists who are heavily investing in AI development.

by Perplexity

While traditional antitrust measures may seem inadequate in addressing this issue, they still play an important role in regulating the AI industry. However, it's essential to recognize the limitations of current antitrust approaches and consider broader reforms to address the underlying power dynamics.The concentration of power in AI development extends beyond individual tech companies, creating a web of influence that spans across multiple sectors. This is evident in the way prominent venture capitalists and tech billionaires are investing in AI startups and political campaigns simultaneously.

For instance, Marc Andreessen and Ben Horowitz, two of Silicon Valley's most famous venture capitalists, have committed to donating to political action committees supporting Trump's campaign. Similarly, Elon Musk has pledged monthly contributions of $45 million to political causes.This intertwining of tech investments and political donations creates a power structure that transcends individual companies. The same individuals who are shaping the future of AI through their investments are also influencing political decisions that could regulate the industry.

This dual influence raises concerns about the effectiveness of traditional antitrust measures.The case of QuantumLight, a venture capital firm founded by Revolut billionaire Nik Storonsky, illustrates how tech magnates are diversifying their wealth and influence. QuantumLight uses AI and algorithms to identify investment opportunities in early-stage companies, backed by a $200 million fund. This approach allows wealthy individuals to extend their influence across multiple startups and sectors, potentially circumventing traditional antitrust scrutiny that focuses on individual companies.

Moreover, the strategy of big tech companies investing in AI startups rather than acquiring them outright presents a challenge for antitrust regulators. Companies like Microsoft, Meta, Amazon, and Nvidia are making significant investments in AI startups without necessarily triggering antitrust investigations. This "quasi-merger" strategy allows big tech to gain control and influence over emerging technologies without the regulatory scrutiny that would come with full acquisitions. The usefulness of antitrust remedies in this context is debatable. On one hand, traditional antitrust measures may seem inadequate in addressing the broader concentration of power among a small group of wealthy individuals. These individuals can easily switch commercial vehicles or create new ones to maintain their influence, potentially rendering company-specific antitrust actions less effective. On the other hand, antitrust remedies still serve important functions:

Market competition: Antitrust actions can help maintain a level playing field for smaller companies and startups, preventing complete domination by tech giants.

Innovation incentives: By preventing monopolies, antitrust measures can encourage continued innovation in the AI sector.

Consumer protection: Antitrust regulations can help ensure that consumers have choices and are not subject to monopolistic practices.

Transparency: Antitrust investigations can bring to light the complex web of investments and influence in the AI industry.

However, to truly address the concentration of power in AI development, broader reforms may be necessary:

Campaign finance reform: Limiting the influence of wealthy individuals on political campaigns could help ensure that AI regulations are made in the public interest rather than serving private interests.

Expanded antitrust scope: Regulators could consider the cumulative impact of investments across multiple companies and sectors when evaluating antitrust concerns.

Increased scrutiny of venture capital: Closer examination of VC firms and their investment patterns could help identify and address potential monopolistic tendencies in emerging technologies.

Data and algorithm regulation: Implementing stricter controls on data collection and algorithmic decision-making could help limit the power of AI-driven platforms.

In conclusion, while traditional antitrust measures remain relevant in the AI context, they are not sufficient on their own to address the concentration of power among a small group of wealthy individuals. A more comprehensive approach that combines antitrust action with broader regulatory reforms and increased scrutiny of investment patterns is necessary to ensure that AI development serves the public interest rather than consolidating power in the hands of a few.

Concentration of Power and Wealth

by Claude

The development of artificial intelligence is largely driven by a handful of tech giants and well-funded startups. However, looking beyond these visible entities reveals a more intricate web of power and influence. The financial backing for these AI ventures often traces back to a relatively small group of ultra-wealthy individuals and venture capital firms.

For instance, companies like OpenAI, DeepMind, and Anthropic have received significant investments from tech billionaires and venture capital firms. Elon Musk, Peter Thiel, and Sam Altman have been involved in funding various AI initiatives. Similarly, venture capital firms like Sequoia Capital, Andreessen Horowitz, and Founders Fund have made substantial investments across the AI landscape.

This concentration of financial power extends beyond the tech sector. The same billionaires and investment firms often have diverse portfolios spanning multiple industries, including media, healthcare, and finance. For example, Peter Thiel's Founders Fund has investments in SpaceX, Airbnb, and Palantir, showcasing the breadth of influence wielded by these investors.

Political Influence

The influence of these wealthy individuals and firms extends into the political realm as well. Campaign finance data shows significant contributions from tech billionaires and venture capitalists to political campaigns and PACs. For instance, OpenSecrets.org has reported on the political spending of individuals like Peter Thiel, who has made substantial donations to various political candidates and causes.

Moreover, lobbying efforts by tech companies and their investors have increased dramatically in recent years, particularly around issues of AI regulation and antitrust policy. This creates a situation where the very individuals and entities that might be subject to antitrust scrutiny have a hand in shaping the regulatory landscape.

The Effectiveness of Antitrust Measures

Given this backdrop, it's pertinent to question the effectiveness of traditional antitrust measures in addressing AI-related market concentration. There are arguments both for and against the usefulness of such remedies:

Arguments for Antitrust Measures:

Market Competition: Antitrust actions can help maintain a competitive marketplace by preventing monopolies or oligopolies in AI development and deployment.

Innovation Incentives: Increased competition could spur more rapid innovation and diverse approaches to AI development.

Consumer Protection: Antitrust measures could help protect consumers from potential abuses of market power, such as price gouging or data exploitation.

Arguments Against Antitrust Measures:

Ease of Circumvention: As the question suggests, the wealthy individuals and firms backing AI companies could potentially create new entities or shift investments to circumvent antitrust actions.

Global Competition: Overly aggressive antitrust measures in one country might hamper domestic companies' ability to compete globally, particularly against state-backed entities in countries like China.

Complexity of AI Ecosystems: The interconnected nature of AI development, with its reliance on vast datasets and computational resources, might make traditional market segmentation difficult.

Conclusion

While antitrust measures in AI are not a panacea, they can still serve a valuable role in shaping the industry's future. However, their effectiveness is limited by the broader concentration of wealth and power among a small group of investors and billionaires.

To address this, a more comprehensive approach might be necessary:

Enhanced Transparency: Requiring greater disclosure of ownership structures and investment flows in AI companies could help identify potential conflicts of interest and concentration of power.

Campaign Finance Reform: Addressing the influence of wealthy individuals and corporations in politics could help ensure that AI regulations serve the public interest rather than narrow corporate agendas.

Global Coordination: International cooperation on AI governance could help prevent regulatory arbitrage and ensure a more level playing field.

Focused Regulation: Instead of solely relying on traditional antitrust measures, regulators might need to develop AI-specific frameworks that address unique challenges like data monopolies and algorithm bias.

In conclusion, while the concentration of wealth and power among AI investors presents significant challenges to traditional antitrust approaches, these measures can still play a crucial role when combined with broader reforms and regulatory innovations. The key lies in adapting our regulatory toolbox to match the unique characteristics of the AI industry and the power dynamics that shape it.

Antitrust in the Context of AI: A Futile Endeavor?

by ChatGPT-4o

In recent years, the explosive growth of artificial intelligence (AI) has been accompanied by substantial investments from a narrow group of billionaires and venture capitalists. This concentration of financial power has sparked debate over the effectiveness of antitrust measures. As the same individuals and investment entities fund both the tech giants developing AI and the politicians shaping policy, the traditional antitrust remedies may seem increasingly impotent. This essay will explore the concentration of wealth and power beyond the tech businesses involved in AI, examining whether antitrust actions are useful or merely symbolic in a landscape dominated by an interconnected power cabal.

Concentration of Wealth and Power

The tech industry, particularly in AI development, is heavily influenced by a handful of billionaires and venture capital firms. Individuals such as Elon Musk, Jeff Bezos, and firms like Sequoia Capital and Andreessen Horowitz have substantial stakes in multiple tech enterprises. These entities do not limit their influence to a single company or even a single sector. Instead, they diversify their investments across numerous high-growth potential areas, including AI, biotechnology, and space exploration.

For instance, Sequoia Capital has invested in Google, Apple, and numerous AI startups, while Andreessen Horowitz has stakes in Facebook, Twitter, and several AI-centric firms. This cross-sector investment strategy ensures that regardless of which specific companies succeed or fail, the overarching investors maintain their influence.

Moreover, these billionaires and venture capitalists often exert significant political influence. Donations to political campaigns, lobbying efforts, and strategic appointments ensure that their interests are well-represented in government. According to OpenSecrets, tech companies and their executives are among the top contributors to political campaigns, ensuring that their voices are heard in legislative processes.

The Limitations of Antitrust Remedies

Given this backdrop, antitrust remedies face significant challenges. Traditional antitrust actions, such as breaking up monopolies or imposing fines, target individual companies rather than the broader network of power. Even if a tech giant like Google or Facebook were to be dismantled, the primary investors would likely reallocate their capital to emerging startups or other tech firms, perpetuating their influence.

The ability of these powerful investors to shift their focus and resources quickly undermines the long-term effectiveness of antitrust measures. For example, if AI development were stifled in existing tech giants due to antitrust actions, the investment would merely flow into new or smaller companies, often ones already in their portfolios, ensuring continuity of control.

The Political Nexus

The intertwining of economic and political power further complicates the antitrust landscape. When the same individuals and entities funding tech companies also influence political decision-making, the likelihood of significant regulatory changes diminishes. Politicians, dependent on campaign contributions and future support, may be reluctant to endorse stringent antitrust measures that could disrupt their benefactors.

This interconnected power structure creates a feedback loop where economic and political influences reinforce each other. Wealthy investors support political figures who, in turn, enact policies favorable to their economic interests, perpetuating the cycle of concentration.

A Potential Path Forward

While the current antitrust framework appears insufficient, alternative approaches could address the underlying issues of power concentration. One potential solution involves increasing transparency in political donations and lobbying efforts. By shedding light on the connections between investors and politicians, public awareness and accountability could pressure for more equitable policies.

Another approach is the promotion of decentralized technologies and open-source AI development. By fostering an environment where technological advancements are accessible and modifiable by a broader community, the monopolistic grip of a few can be weakened. This could democratize innovation and reduce dependency on a handful of powerful investors.

Conclusion

In conclusion, the concentration of wealth and power among a select group of billionaires and venture capitalists presents significant challenges to the effectiveness of traditional antitrust measures in the context of AI. As these entities possess the ability to swiftly shift investments and maintain political influence, antitrust actions targeting individual companies fall short of addressing the broader issue of power concentration. To create a more equitable and competitive landscape, alternative strategies focusing on transparency, decentralization, and public accountability must be pursued. Only through such comprehensive measures can the true potential of antitrust actions be realized in the age of AI.

Flashback: “Thiel is, as you probably know, a Silicon Valley billionaire superstar who co-founded PayPal and Palantir Technologies, a controversial software firm that specializes in big data analytics and receives much of its revenue from government contracts. He is very pro-Trump. And his message to these angry conservatives was that there is now a ferocious battle going on between the forces of free thought and those of dogmatism. In a rambling speech, he offered what he called his “reflections on the incredible derangement of various forms of thought, political life, scientific life…in this country over the last few years and what we perhaps can do to counteract this derangement.” As he veered from one half-thought to the next, he presented three examples of what he had in mind: COVID-19, Afghanistan, and the Federal Reserve. Each of these subjects, he explained, demonstrated the dominance of wrongheaded and enforced consensus over dissent and individualized thinking. (I’m being more articulate than he was.) And what was scary about his talk is how simplistic his supposedly sophisticated analysis was. (…) And this year, Thiel has committed $10 million to help J.D. Vance, the once-anti-Trump Hillbilly Elegy author and venture capitalist who has become a pro-Trump troll and is running for senator in Ohio. Without all that moolah, Thiel’s quasi-ideas would be easy to dismiss.

Bovard’s speech was indeed frightening. It was full of venom, anger, and unfounded paranoia. Thiel’s presentation was far more disturbing…for billions of reasons.” Source: https://www.motherjones.com/politics/2021/11/how-dangerous-is-peter-thiel/

Source: https://money.usnews.com/investing/articles/7-top-investment-firms-using-ai-for-asset-management